How to Nail Your Next Startup Presentation

In 2022, 47 percent of startups failed due to a lack of funding. If you’re feeling uneasy about nailing your next startup presentation, we feel your pain.

We won’t lie to you; raising funds is one of the most nerve-racking parts of building a startup. Sadly, that’s something most startups will do at one point or another. Your big idea has existed in your mind for a while. You’ve probably even built an MVP that’s already gaining traction.

But to scale, you need funding, which is why you need a pitch deck to bring your idea to life in the minds of potential investors. We’re here to give you a much-needed leg up on fundraising.

In this article, we’ll show you how to nail your next startup presentation.

The Basics of a Startup Presentation

A startup presentation, also known as a pitch deck, is a concise and visual summary of your business concept that you show to prospective investors to convince them to fund your business.

Although potential customers can also be the target audience, we will concentrate on VCs and angel investors in this article.

A pitch deck typically contains information about your target market, your product’s specifications, your general vision, and the problem your product is attempting to solve.

But let’s be more realistic: A startup presentation will not get you an immediate check. You know, no one moves on to signing a check immediately after the presentation.

So this is more about grabbing investors’ attention and securing the next meeting—without this, you most likely won’t advance to the funding stage.

Having said that, pitching to investors isn’t the same as pitching to customers. Let’s take a cursory glance at the differences between the two.

Here is a quick rundown of the differences between pitching to either of the two:

- Audience: The primary distinction lies in the target audience. When pitching to investors, your audience consists of potential financial backers who are primarily interested in the business’s financial viability, growth potential, and return on investment. On the other hand, when pitching to customers, your audience comprises individuals or organizations that are potential consumers of your product or service. They are more concerned with the value proposition, benefits, and features of the offering.

- Objective: The objective of pitching to investors is typically to secure funding for your business. Conversely, when pitching to customers, the primary goal is to generate interest and persuade them to purchase your product or service.

- Language and tone: The language and tone of the pitch will vary based on the audience. When pitching to investors, you need to adopt a more analytical and financial tone. In contrast, when doing sales presentations, the language should be more relatable and customer-centric, addressing their emotions, desires, and aspirations and using a tone that resonates with them.

The Power of a Great Pitch Deck

As an entrepreneur trying to raise capital, the sole purpose of a pitch deck is to provide potential investors with engaging information about your business and vision.

This allows you to secure buy-in for your business goals and secure their funding.

But let’s break that down into bits. Here are some benefits of a pitch deck:

- Attracting investors: A well-prepared pitch deck can attract potential investors by showcasing the investment opportunity. It allows you to outline your business model, competitive advantage, and potential return on investment. Investors often rely on pitch decks as an initial screening tool, and a compelling deck can significantly increase your chances of securing funding.

- Clarity and structure: A pitch deck provides a structured framework for presenting your startup. It helps you organize your thoughts and present information logically, ensuring your audience can easily follow your narrative. This clarity enhances your chances of capturing their attention and conveying your message effectively. In other words, it’s the opposite of winging it.

- A road map to your marketing plan: A pitch deck allows you to tell a compelling story about your startup. By weaving together your vision, problem-solving approach, market opportunity, and unique selling points, you can identify potential ways to captivate your audience and create an emotional connection.

Pitch Deck Template: A Starting Point

A pitch deck template, or presentation template, comes with sections and slides for key elements in your pitch, such as the problem statement, marketing analysis, solution, team, financials, vision, and so on.

Whether in a PowerPoint, Google Slides, or Keynote presentation, it should encapsulate your business idea, metrics, and potential growth.

With all these sections already pre-organized, all you have to do is enter your content and customize it as you see fit.

While we have absolutely nothing against building from scratch, you need a template if you want to do well. I mean, why waste time and resources building from scratch when you can build on others’ successes?

The Buffer pitch deck and the Mint pitch deck are great examples to consider. But if you need something you can copy right away, look at our pitch deck templates.

The Content: What Should Your Startup Pitch Deck Include?

While pitch deck templates will help you move fast by providing you with the framework you need, you can’t fly blind.

Knowing what a typical pitch deck should include will allow you to select the right template, modify the template as necessary, or even build yours from scratch if necessary. It will also give you confidence that you know what you’re doing.

Here, we’ll talk more about what your startup pitch must have.

The Problem and Your Proposed Solution

Mentioning the problem your product solves and the solution it is putting forward to solve it is the first key element of a pitch deck.

This section should clearly explain what your startup does. The key here is to be precise, concise, and passionate.

Even though it’s true that investors love solid numbers and projections, what’s even truer is that they’re humans. So, how do you elicit interest from humans?

Through great storytelling—a real, human story they can easily relate to. This is what helps you bring all your data to life

One great example I can think of is that of Dropbox, a file-hosting service company.

Although this isn’t the typical story of any individual, real or imaginary, it’s a story we can all relate to.

In just six presentation slides, Dropbox:

- Got our attention with the catchphrase “Storage is a mess,” supported with a picture of untidy office space (The story)

- Shared what it feels like to share files in 2007 (The problem)

- Explored the pain points by sharing how people are sharing files

- Explained the alternative way to do it (The solution)

- Demonstrated how Dropbox does it (The value proposition)

Show why your startup exists and what problem it’s solving; the goal is to intrigue your audience and make them curious about the rest of your presentation.

Once you open with a story that makes them ask, “What then?” you’ll have them spellbound for the next few minutes of your time.

A Clearly Developed Business Plan

Investors have heard your story, and it’s touching. Kudos! But they also need to know your business plan. It’s the only way they can tell you aren’t just stirring up emotions and that you can indeed build a business.

This section should answer questions on:

- Your marketing and sales plan: How do you plan to acquire users? Describe your marketing and sales approach, including how you plan to reach and acquire customers. You should highlight any unique marketing strategies, partnerships, or customer acquisition channels that differentiate you from competitors.

- Business model and monetization strategy: Explain how your business will generate revenue and achieve profitability. Whether it’s a direct sales model, a freemium model, or a subscription model, be clear and specific.

- Your financial projections: Provide a summary of your financial projections, including revenue forecasts, expenses, and profitability estimates. Use charts, graphs, or visuals to illustrate your financial data clearly. Address key financial metrics such as return on investment (ROI) and break-even analysis.

That’s how they’ll assess your business plans and see if you have a viable business strategy, not just touching stories.

Real Product-market Fit

Have you attained product-market fit yet? If yes, that’s another important thing you should add to your pitch deck.

In fact, it would be wiser to wait until you have established some traction before considering making an investor presentation. But don’t take my word for it.

Take it from Joel Gascoigne, the co-founder of Buffer, who’s been there, done that:

“So my advice for first-time founders who want to raise funding is almost always to put that thought aside until you have good traction. Instead, focus completely on traction. Focus on product/market fit. When you have good traction, it becomes much easier to raise funding,” Joel says.

The reason is clear: it gives investors confidence that your business has a market.

A solid product-market fit also indicates that your business has the potential for scalability and growth. It suggests there is a large enough customer base willing to adopt and pay for your product or service, which is a great motivation for investors.

What’s more, investors are risk-averse and seek businesses with proven product-market fit. By demonstrating that you have already validated your offering in the market, you can reduce the perceived risks associated with customer adoption and market acceptance.

Defined Market Size

To give investors and other stakeholders a clear picture of the potential opportunity and the size of the market you intend to target, it is essential to define the market size in a pitch deck.

It signifies you have conducted thorough market research, identified a viable target market, and can articulate the revenue potential of your business.

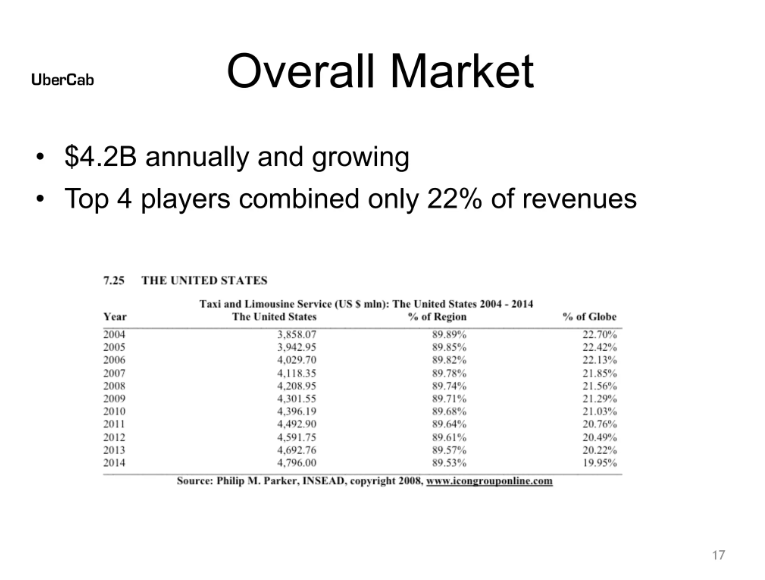

Here is a good example from Uber’s pitch deck.

To effectively define the market size in your pitch deck, consider the following steps:

- Identify the relevant market: Clearly define the specific market or industry that your business operates in. Identify the key characteristics, trends, and dynamics of the market, such as its size, growth rate, and major players.

- Determine the total addressable market (TAM): Estimate the total market size by considering the entire potential market for your product or service. This includes all customers who could benefit from your offering, irrespective of your specific target audience or segment.

- Define the serviceable addressable market (SAM): Narrow down the market size by identifying the portion of the total addressable market that you can realistically target and serve. Consider factors such as geographic location, customer demographics, or specific industry verticals that align with your business strategy.

- Calculate the target market share: Estimate the percentage of the serviceable addressable market that you aim to capture. This projection should be based on realistic assumptions, taking into account factors such as competition, market adoption rates, and your marketing and sales strategies.

- Provide context and rationale: Explain the basis for your market size estimation, including the research methods, data sources, or industry reports used. If available, mention any relevant market trends, growth projections, or market research findings that support your market size estimation.

Initial Proof of Concept

Proof of Concept (POC) is a vital step in validating an idea, and investors need to know if your idea is working or going to work. This goes beyond vanity metrics like the number of shares on social media or the number of new customers on launch day.

Instead, use metrics like customer retention, the number of positive reviews, etc.

You can achieve this by gathering robust and reliable data through trials, surveys, user tests, or market research, which further supports the value of the concept.

Visual representations such as wireframes, prototypes, screenshots, charts, or graphs can also effectively convey the essence of the POC.

When presenting the concept, integrating the collected data into a pitch deck with concise and impactful language helps highlight key metrics, visual representations, and any positive outcomes or results achieved thus far.

Of course, this is only applicable to startups that are still in the beta stage. If you’ve already achieved product-market fit and more users are adopting your product, showing product-market fit should suffice.

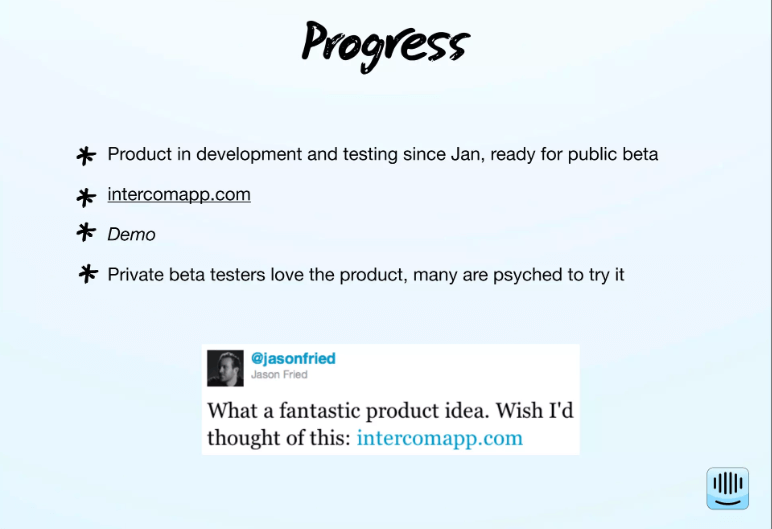

Here is an example of POC from Intercom pitch deck:

The Competition

It’s okay to know your competitors and acknowledge them in your presentation. I mean, they’re one of the lurking threats to your success, and acknowledging them in your presentation will put the minds of your potential investors at rest.

This means you understand the market landscape and have a strategy to stand out.

The competition slide of your capital pitch deck is also an opportunity to differentiate your product or solution by highlighting unique selling points and competitive advantages, giving investors a compelling reason to choose your company over competitors.

Moreover, Joel, the co-founder of Buffer, emphasizes this. He explains how talks with investors suddenly stalled because “the media space seems crowded.”

“So after lots of meetings, we realized that the competition question (in our case) created the most friction and eventually left people too confused and not interested anymore,” he says.

Moreover, analyzing the competition validates market demand, helps identify growth opportunities, supports strategic planning, and mitigates risks.

Your Team

Investors don’t just invest in ideas; they invest in people. Showcase your team and highlight their skills, experiences, and previous successes. Show why your team is the best to execute the plan and why you can navigate the challenges of building a startup.

What are investors looking for in a team? These three qualities:

- Credibility and expertise: Investors want to see a competent and capable team behind a business. Highlight your team members’ respective experiences to prove your team possesses the necessary skills and experience to execute your business plan successfully.

- Track record: Investors often look for a track record of success when evaluating startups. Mentioning team members who have previous entrepreneurial or industry experience, successful ventures, relevant academic achievements, or notable accomplishments helps establish a positive track record.

- Complementary skills: Highlighting the diverse skill sets of your team members is important to showcase that you have a well-rounded team capable of handling various aspects of the business.

Here are the things your team slide should contain:

- Roles and responsibilities

- Achievements and experiences

- Brief bios

Projecting Your Financial Model

Here, honesty is key. Be clear about your current financial status and future projections.

Your potential investors want to understand your burn rate, revenue streams, and profitability timeline. It’s also important to discuss how much funding you’re seeking and how it will be used to grow the business.

Here is how to do it:

- Start with a summary: Begin by providing a high-level summary of your financial projections. Include key metrics such as revenue, profitability, and growth rates to provide an overview of the financial potential of your business.

- Breakdown of revenue streams: Present a breakdown of your revenue streams, outlining the different sources of income for your business. This could include product sales, subscriptions, licensing fees, or other revenue-generating activities.

- Explain the assumptions and drivers: Clearly communicate the assumptions and key drivers behind your financial projections. Explain the factors influencing revenue growth, such as market size, customer acquisition rates, pricing strategy, and market share. Additionally, highlight the key cost drivers, such as production costs, marketing expenses, and overheads.

- Sales forecast: Provide a detailed sales forecast that outlines the expected sales volume and pricing. Break it down by product lines or customer segments, if applicable. Use visuals, such as line charts or bar graphs, to present the projected sales growth over time.

- Expense projections: Present your projected expenses, including fixed and variable costs. This may include production costs, marketing and advertising expenses, salaries and benefits, research and development costs, and operational expenses. Use tables or pie charts to illustrate the expense breakdown and how it aligns with your revenue projections.

Nail Your Startup Presentation: 4 Tips to Pitch Like a Pro

We’ve highlighted the things your slide deck should involve. Now, it’s time to talk about how to present your well-prepared pitch deck to potential investors.

And believe me, even the best pitch deck can flop in the hands of an uncharismatic presenter.

Follow these methods to make your pitch convincing and credible:

1. Sell the Value, Not the Product

A startup pitch isn’t a place to wax lyrical about your great features.

The main question they expect your presentation to answer is: why will the user stick to your product?

Take the below statement, for example:

“We are excited to introduce our startup, TechTrack, and the transformative value it brings to the logistics industry. We have identified a critical problem that plagues the industry: inefficiencies and delays in supply chain management. Our solution leverages advanced AI algorithms and predictive analytics to optimize logistics operations, resulting in significant cost savings and streamlined processes.

By implementing TechTrack, our customers can experience tangible benefits, including a 30 percent reduction in delivery lead times and a 20 percent decrease in transportation costs. These improvements translate into higher operational efficiency and improved customer satisfaction for businesses across the supply chain.”

In this example, the focus is on clearly articulating the problem, highlighting the specific benefits and cost savings, and providing market validation. By selling the value and impact of the startup, investors are more likely to see the potential return on investment and the long-term viability of the venture.

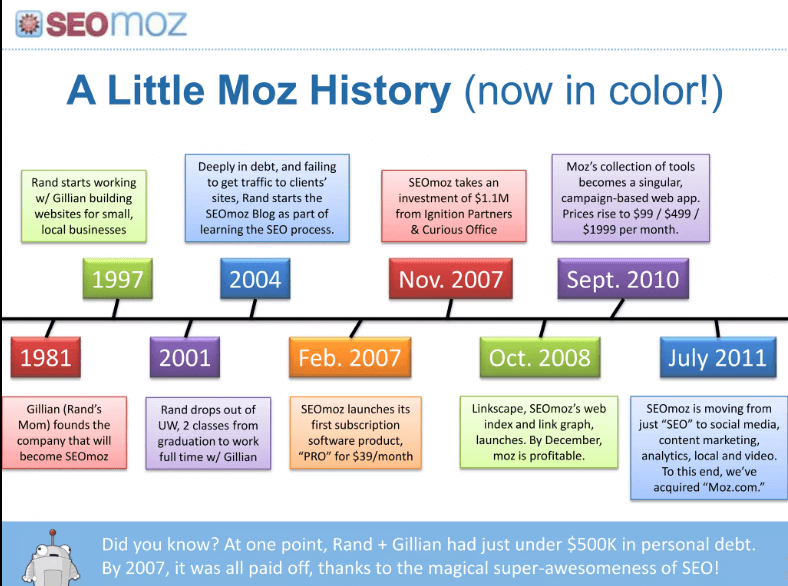

2. Turn It into a Story

One way to get investors to remember your startup is to tell its story. Big numbers work, of course. But storytelling makes it all memorable and fun.

The idea is to tell a compelling story and use a milestone slide to demonstrate your journey and achievements so far.

Take it from SEOmoz (now Moz). The pitch started with a story of how a boy and his mother launched a startup together, how they’ve grown, and how they’re helping other companies do the same.

Their pitch deck also showcased how far they’ve come with their business and where they are headed.

It’s one of the greatest examples of data-driven storytelling.

3. Use Visuals That Speak for You

Don’t be afraid to use design within your pitch deck to drive your message home.

As an organization, you should develop a strong visual identity that aligns with your brand. This includes selecting a color palette, typography, fonts, and graphics that represent your startup’s personality and values. Use consistent design elements throughout your pitch deck to create a cohesive and professional look.

You can also incorporate relevant images, illustrations, or icons to enhance the visual appeal. For example, you can use images that showcase your product, illustrate customer success stories, or depict market trends and data. And don’t be afraid to use memes. The bottom line is: get creative.

If applicable, use product mockups, wireframes, or screenshots to give investors a tangible sense of what you’re offering. This helps them visualize the potential and value of your solution.

4. Engage with Potential Investors

During your pitch, make sure you read the room and adapt. The rule of thumb is to keep your presentation to 5-20 minutes and let your audience decide how much longer it will get after that. A simple pitch deck that briefly explains your startup idea will allow your audience to ask questions, and you to engage with them.

Use your pitch deck as a guide, not a script. Answer any FAQs your potential investors might have and be open to critique. Engage them in conversation, and don’t be afraid to ask for advice.

A Quick Look at Successful Pitch Deck Examples

Studying successful startups is a great way to learn and avoid common pitfalls. For instance, Uber and Airbnb have incredibly successful pitch decks that have been studied and imitated for years.

They laid out their key metrics, presented a clear value proposition, and demonstrated a deep understanding of their target audience.

Knowing what they did right can help you follow in their footsteps. Here are three good examples of great startup presentations

SEOMoz (Now Moz)

Moz is an SEO tool that gives you information on your search ranking performance to help you gain better visibility on search engines.

In 2011, SEOMoz presented one of the most captivating investor pitch decks in the SaaS industry. It raised 11 Million USD and ended up becoming one of the most frequently referenced startup presentations in Silicon Valley.

What they did well:

- Powerful storytelling: How a tiny Mom + Son consultancy became the world leader in SEO software and our roadmap to being Seattle’s next $1 Billion company

- Mentioning their margin and growth trajectory

- Mentioning the marketing strategy that made it possible and linking it to their product and how it will help other companies

- Lots of visuals

Buffer

Buffer lets you manage and grow your social media account by providing a tool that lets you schedule posts and analytics to track your performance.

Another widely cited startup presentation in the SaaS industry is Buffer’s, and the reason is obvious.

Aside from using this deck to raise half a million dollars, Buffer is one of the most successful tech startups out there.

What they did right:

- Emphasizing traction and explaining it with numbers and a graph

- Mentioning their milestones

- Brevity

- Stressing how they are different from their competitors

Intercom

Intercom is a customer engagement platform that lets you have real-time conversations with customers.

In 2011, Intecom raised 600 million USD in an investment round. It was succinct and captivating.

Two things made the Intercome pitch deck stand out:

- Brevity

- Sharing a private beta tester’s reaction

A Winning Pitch Deck Presentation: The Beginning of Successful Funding

To attract investors, give a compelling startup presentation. After your startup presentation, there is still a long way to go before you can really acquire the funding, but this first step is crucial if you hope to get it at all.

Pay close attention to the two main points of this post: the key contents of a startup presentation and its delivery.

We’ve highlighted what investors are looking for, how you can build your pitch deck, and how to present it to win. Now, it’s up to you.

Recent Comments